Contact Oona Integrated Claims immediately via the Call Center, WhatsApp Business, Email, or via the Website.

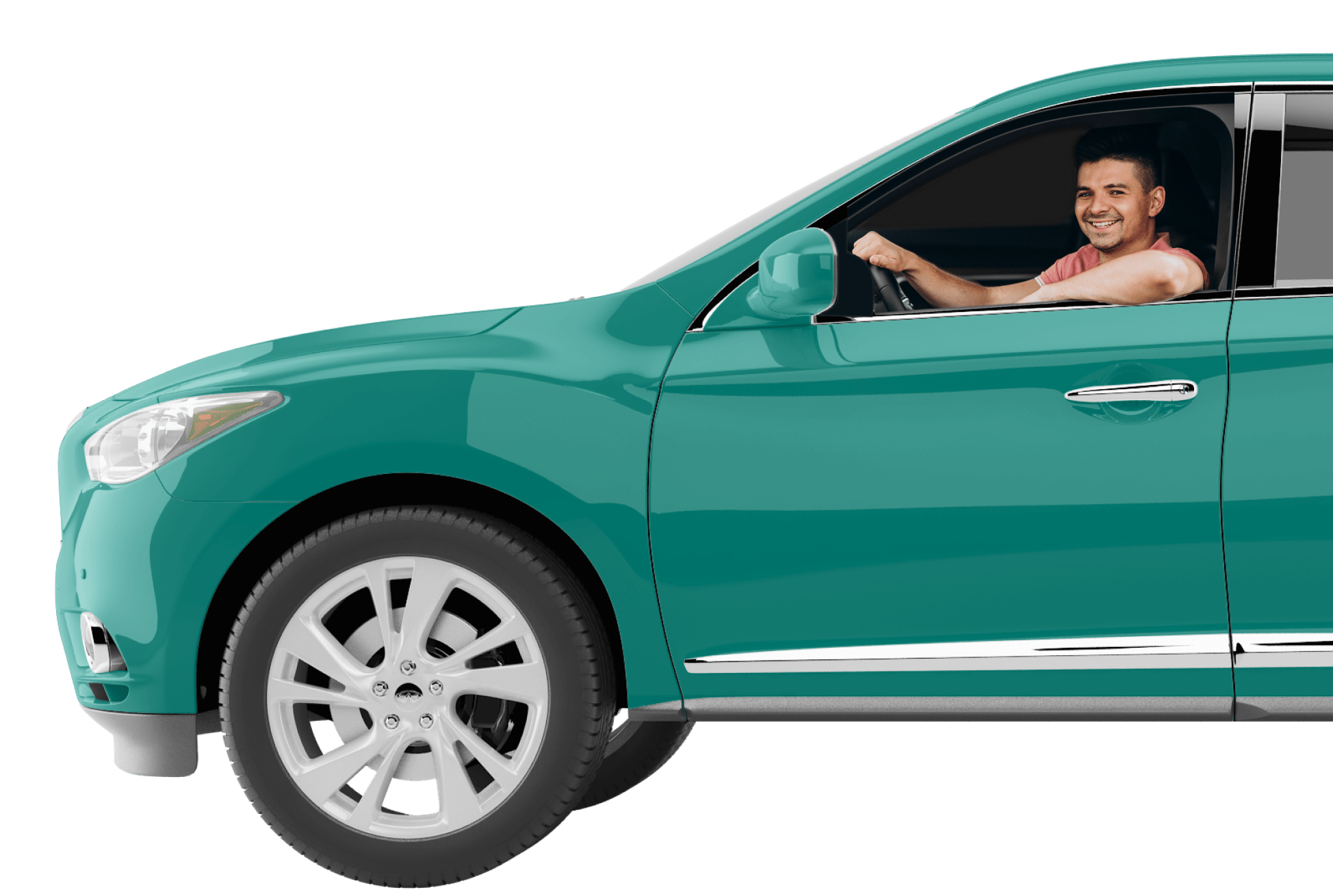

Complete the claim documents online, and do an online survey via WhatsApp assisted by Oona Surveyor.

Approval of claims on the same day for minor damage without replacement of spare parts.

Unduh brosur

Unduh brosur